Despite facing significant tax disadvantages, the Edmonton Oilers had a fantastic 2023-24 season. While their season didn’t start on the best note, the team went on a flyer once the organization hired head coach Kris Knoblauch and Paul Coffey to assist. They ended their season by taking the Florida Panthers to Game 7 of the Stanley Cup Final. Although they didn’t clinch the Cup, their achievements were remarkable. That’s even more true considering their financial challenges given the different tax structures they face.

Related: NHL Rumors: Oilers, Maple Leafs, Capitals, Kuznetsov News

Recently, Nashville Predators GM Barry Trotz highlighted the substantial edge no-tax states possess in signing and retaining players. In short, he explained that players naturally want to maximize their earnings by keeping as much of their money as possible. This financial benefit makes no-tax states more attractive to players than those with higher tax rates, such as Canadian provinces. While he emphasized that this tax advantage is not the only factor in building a successful team, it is significant. This puts Canadian teams like the Oilers at a clear disadvantage.

The Impact of Tax Disparities

The long and the short of it is that the tax disparities between Canada and the United States have created financial challenges for Canadian teams in attracting and retaining top players. Higher tax rates in Canada compared to many U.S. states often lead players to prefer signing with U.S.-based teams to maximize their net income. This preference for U.S.-based teams significantly affects Canadian teams’ ability to compete in the player market.

$8,625,000 through 2031-32. Could that have happened in Canada? (Photo by Peter Joneleit/Icon Sportswire via Getty Images)

The tax differences between the two countries also directly impact the net value of contracts, influencing how Canadian teams manage the salary cap and structure contracts. Canadian teams must carefully consider the after-tax value of contracts to offer competitive deals that can attract and retain talented players, further complicating their financial management and roster-building efforts.

Ultimately, these tax disparities create competitive disadvantages for Canadian NHL teams. It makes it more difficult for them to build and maintain strong rosters. This issue not only affects the financial dynamics of the market but also influences player decisions and overall team performance, leading to a complex landscape in which Canadian teams must navigate to remain competitive in the NHL. Is it surprising that the last Canadian team to win the Stanley Cup was the Montreal Canadiens? That was thirty-one years ago, in June 1993.

Related: Knoblauch’s Path to Become Oilers’ Game-Changing Coach

Despite these challenges, the Oilers had an impressive season. Reaching Game 7 of the Cup Final is a testament to their resilience and skill. Given their financial hurdles, their achievements should be celebrated even more.

The Last Five Seasons and Stanley Cup Winners

The last five teams to win the Stanley Cup defend the notion that Canadian teams are at a disadvantage:

- Florida Panthers – 2023-24

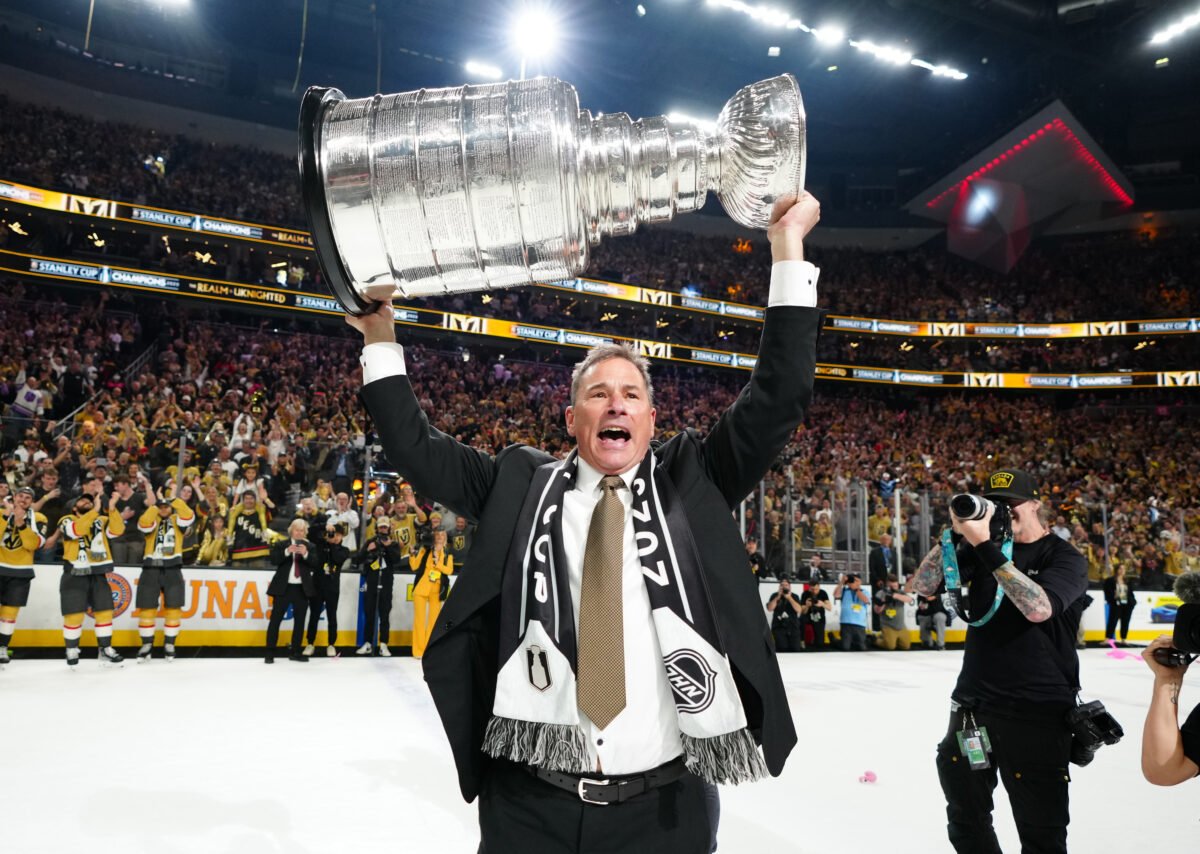

- Vegas Golden Knights – 2022-23

- Colorado Avalanche – 2021-22

- Tampa Bay Lightning – 2020-21

- Tampa Bay Lightning – 2019-20

All of these teams hail from states with favourable tax environments (Florida, Colorado, and Nevada). Colorado has a flat state income tax rate of 4.55%, while Nevada and Florida stand out for not having any state income tax, providing residents in these states with potentially significant savings.

(Photo by Jeff Bottari/NHLI via Getty Images)

While tax advantages are significant, they are not the sole reason a team has success. Management, ownership, market appeal, and organizational relevance are crucial. Teams in no-tax states have a competitive edge. However, exceptional management, as seen with general manager (GM) Ken Holland last season with the Oilers and GM Patrik Allvin with the Vancouver Canucks also helps. Furthermore, no one should argue that a GM like Bill Zito of the Panthers did not have his head screwed on right. He’s sharp.

The Bottom Line: Even More Reason to Celebrate Oilers Success

The Oilers’ success last season highlights their ability to compete despite financial disparities. Adjusting the salary cap to account for tax differences could help level the playing field. However, for now, teams in no-tax states will continue to leverage their unique advantage.

Related: Today in Hockey History: July 25

The purpose of this post is not to whine so much as to underscore the Oilers’ considerable financial hurdles due to higher tax rates. It also puts into perspective the advantages teams in no-tax states have, making the Oilers’ achievements even more commendable.

The Oilers offer other Canadian teams hope. Their very competitive postseason shows that a Canadian team can rise and compete even with those teams located in advantageous financial geographies.